Multi state paycheck calculator

Paycheck Calculator California State Controllers Office. The state tax year is also 12 months but it differs from state to state.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Federal Salary Paycheck Calculator.

. For example if an employee earns 1500. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. If your employer doesnt withhold for Massachusetts taxes you will have to pay those taxes in a lump sum at tax time or make estimated tax payments to the state using form Form 1-ES.

All Services Backed by Tax Guarantee. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. 686 form to reflect the redesign.

Multi-state payroll can refer to the following situations. Salary Paycheck and Payroll Calculator. In fact at times the employer might need to.

If a business is said to have nexus it means the business has a. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. Go To Gross-Up Calculator.

Your household income location filing status and number of personal. We use the most recent and accurate information. For example if you earn 2000week your annual income is calculated by.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. Ad Create professional looking paystubs.

Paycheck Calculator Download. If you have questions about Americans with Disabilities Act. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The resident tax is computed on the wages earned in the resident state. In the tax world nexus refers to a businesss connection between a taxing jurisdiction such as a state county township etc. Calculating paychecks and need some help.

This form can usually be found in the states part-year or nonresident income tax return. You use the schedule to apportion how much of your income is taxable in each state. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

California government employees who withhold federal income tax from wages. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Multi-state payroll is this same process of calculating withholding and payingbut in multiple states.

In a few easy steps you can create your own paystubs and have them sent to your email. Enter your annual salary or earnings per pay period. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Then the wages earned in the nonresident. If an employer has operations in more than one state income tax might need to be withheld for multiple states.

The Full Methodology follows the following procedure. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Some states follow the federal tax.

Subtract any deductions and. This number is the gross pay per pay period. How to calculate annual income.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W-4. The State Controllers Office has updated the Employee Action Request STD.

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

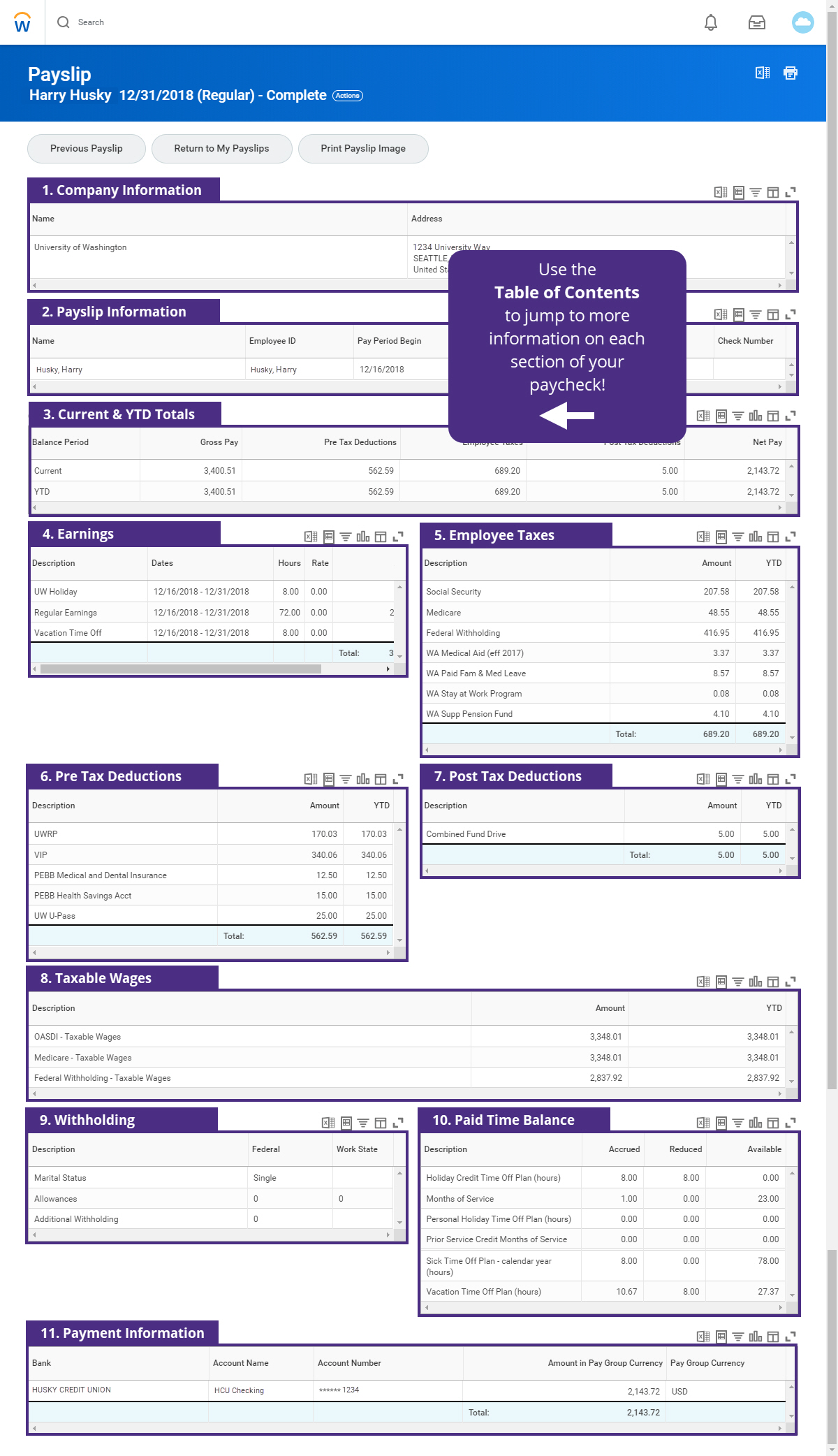

How To Read Your Payslip Integrated Service Center

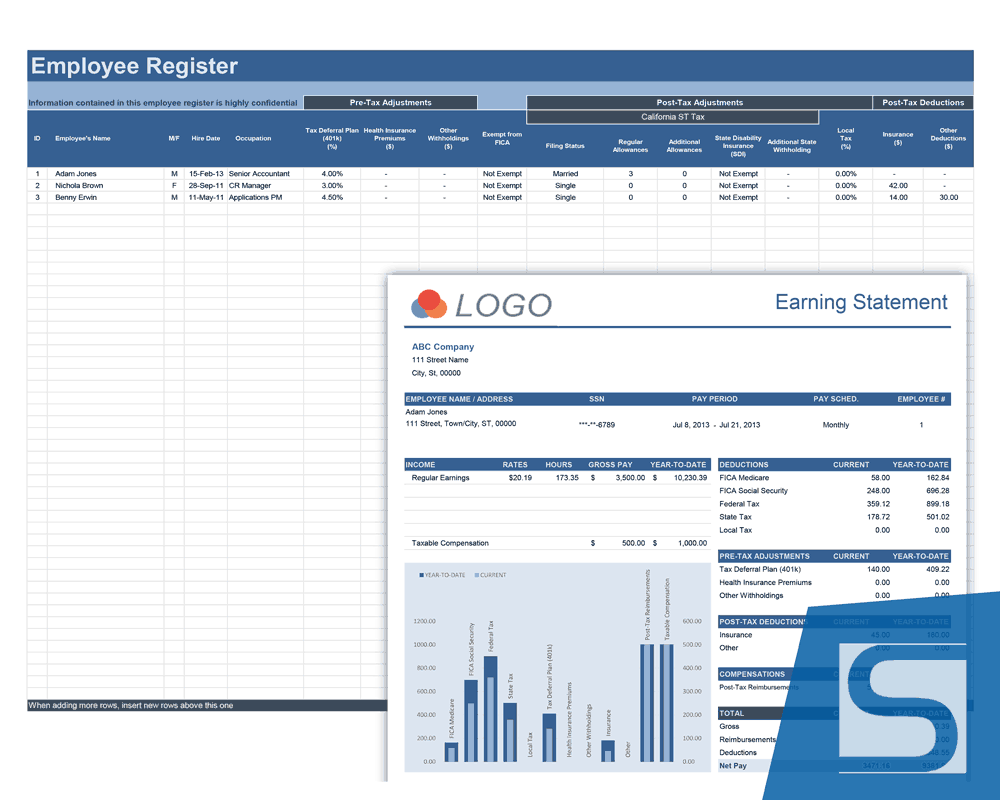

Payroll Calculator Free Employee Payroll Template For Excel

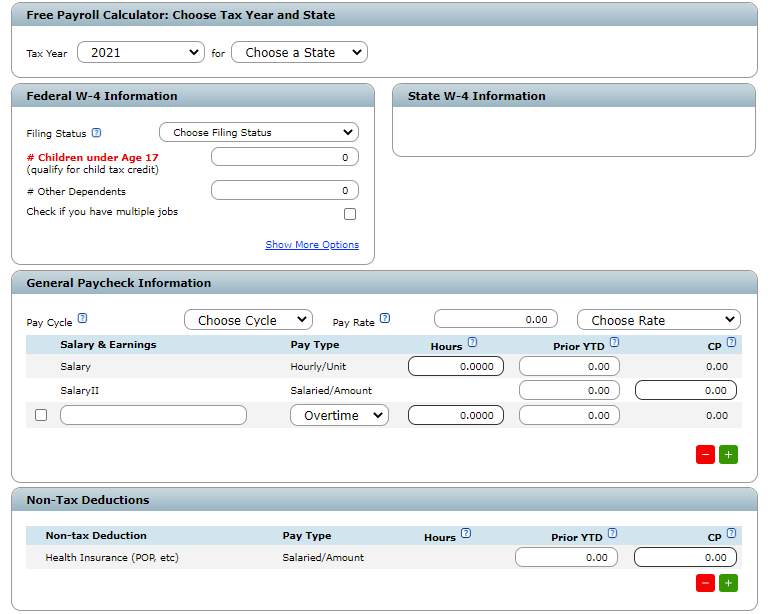

Paycheck Manager Review Is It The Right Payroll Software For Your Business

Pay Stub Meaning What To Include On An Employee Pay Stub

Multi State Payroll

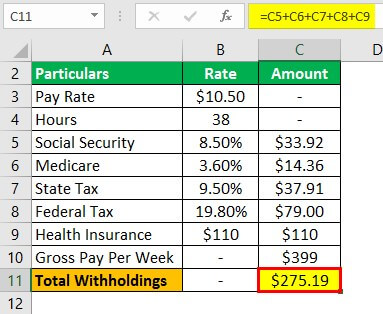

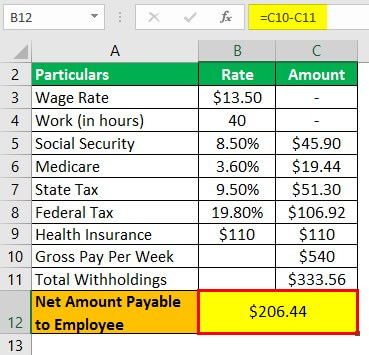

Payroll Formula Step By Step Calculation With Examples

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Take Home Pay Calculator

Create Pay Stubs Instantly Generate Check Stubs Form Pros

How To Gross Up A Net Value Check

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Calculating An Employee S Gross Pay Is Already Complex With The Numerous Factors To Consider Including The Number Of Hours Payroll Software Payroll Income Tax

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Formula Step By Step Calculation With Examples

Paycheck Calculator Take Home Pay Calculator

Multi State Payroll